AI for investment & finance with Wealthfront. Automated investing, tax-loss harvesting, and personalized financial planning.

Pricing Model

Pricing Plans

Automated Investing Accounts

Annual Advisory Fee: 0.25% of assets under management, deducted monthly.

---

annual

Automated Bond Portfolio

Annual Advisory Fee: 0.25%.

---

annual

Automated Bond Ladder

Annual Advisory Fee: 0.15%.

---

annual

S&P 500 Direct Portfolio

Annual Advisory Fee: 0.09%. Minimum Initial Deposit: $5,000.

5,000

---

Nasdaq-100 Direct Portfolio

Annual Advisory Fee: 0.12%.

---

annual

Stock Investing Account

No advisory or management fees; no commissions. Wealthfront does not accept Payment for Order Flow (PFOF).

---

---

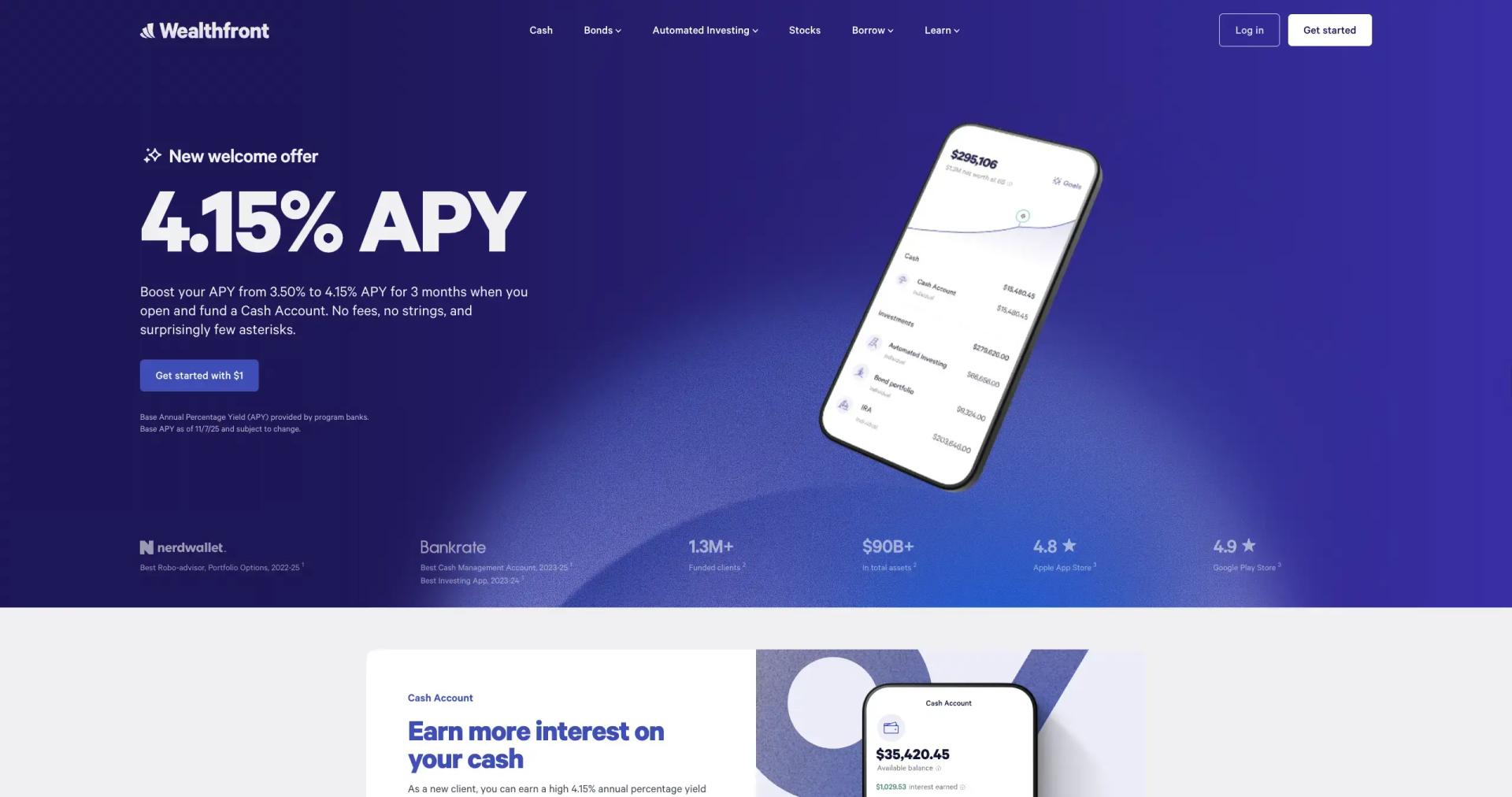

Cash Account

Account Fees: None. Annual Percentage Yield (APY): Base APY of 3.50% as of November 7, 2025, subject to change.

---

---

Cash Account Promotional Offer

Promotional Offer: New clients can receive a 0.50% APY boost for 4 months, resulting in a 4.00% APY during that period.

---

---

Debit Card Fees - In-Network ATM Withdrawals

In-Network ATM Withdrawals: Free.

---

---

Debit Card Fees - Out-of-Network ATM Withdrawals

Out-of-Network ATM Withdrawals: $2.50 plus any ATM owner fee; Wealthfront reimburses fees up to $7.50 for each of the first two domestic out-of-network ATM withdrawals per month.

2.5

---

Debit Card Fees - Bank Teller Withdrawals

Bank Teller Withdrawals: $2.50 plus any teller fee.

2.5

---

Debit Card Fees - International Transaction Fee

International Transaction Fee: 2.75%.

---

---

Debit Card Fees - Cash Deposits at Select Retailers

Cash Deposits at Select Retailers: Up to $5.95.

---

---

General Account Fees

Wealthfront does not charge account-opening fees, withdrawal or account-closing fees, trading/commission fees, or account transfer fees.

---

---

Discover alternative AI tools similar to Wealthfront that may better suit your needs.

Explore professional roles that benefit from using Wealthfront.